- ATMs / Branches

- Appointments

- Rates

- News

- Specials

- Fraud Alerts

- Privacy

- Contact Us

- Search

Search

- Routing Number (ABA): 321379106

SCAMS ARE ON THE RISE

Recently, members have reported receiving suspicious text messages and phone calls from a spoofed Hickam Federal Credit Union phone number requesting to validate their personal information. If you receive such a message, do not respond to these requests.

As a reminder, Hickam Federal Credit Union will never contact you to ask for your personal or financial information or ask for you to provide your debit/credit card number, PIN number, or online/mobile banking login information.

Please call us directly at 808.423.1391 or toll-free at 800.432.4328 if you are unsure.

RED FLAGS TO LOOK FOR:

Members have reported receiving suspicious phone calls requesting to validate their personal information and debit card or to provide their card number. The calls originated from a spoofed Hickam FCU phone number. Do not respond to these requests.

Be suspicious of calls posing as security employees, card companies and their fraud services, or other suspicious entities requesting for you to update, change, or provide personal information about your debit card, passwords, and other secure information.

As a reminder, Hickam Federal Credit Union will never ask for your personal or financial information or ask for you to provide your debit card number.

Also, closely monitor your card statements and accounts and report any unusual activities or discrepancies as soon as possible.

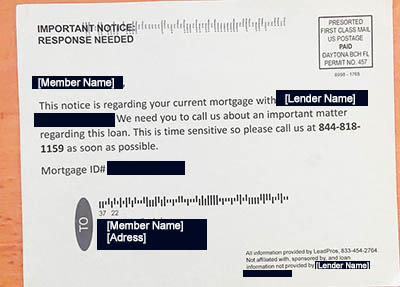

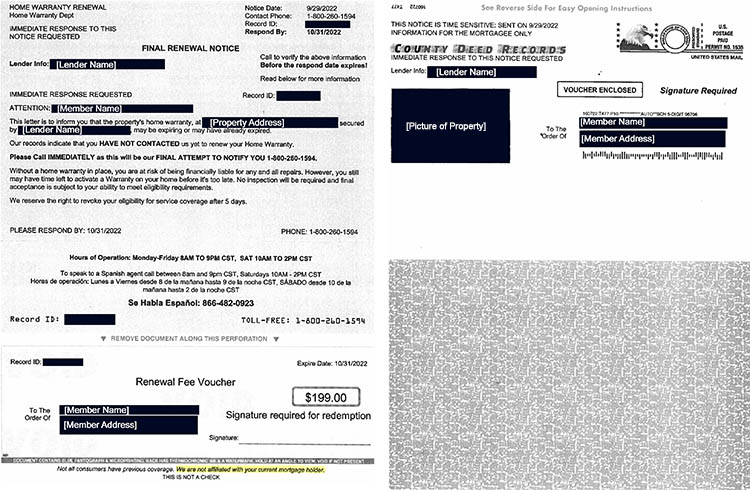

Fraudsters are obtaining property address, ownership, and lien holder information from public information sources such as local conveyance/deed and property tax records to scam homeowners into purchasing illegitimate products or services, or to obtain your personal information. These scammers offer homeowners with unnecessary services such as home warranties, recorded deed notices, protection insurance and other “urgent and time sensitive” offers.

Please know that financial institutions such as Hickam FCU do not share these types of information with non-affiliated companies. You may even notice a disclaimer that specifically states that “All information provided is not affiliated with, sponsored by, and loan information not provided by Hickam Federal Credit Union." We recommend that if you receive such offers in the mail, please do not respond to their request for contact and securely discard the mail piece.

Here are a few examples:

With the tragedies unfolding on Maui and Hawai'i Island, scammers are taking advantage of the crises to create fraudulent fundraisers. If you are looking for opportunities to donate or to help these communities, please use vigilance when selecting a charity. The Department of the Attorney General Hawai'i shared the following tips to avoid falling for donation scams:

If you have any questions or complaints regarding a scam charity, please contact the Tax & Charities Division at 808.586.1480, or send an email to [email protected].

The Honolulu Police Department is warning the public about credit card skimmers that are illegally installed at self-checkout registers, ATMs, and gas stations. These skimmers are attached to the actual card reader and will transmit credit and debit card information to thieves when a card is used.

Although the skimmers may look real, here are a few ways you can check.

If you believe a card skimmer has been illegally installed, notify an employee immediately.

Our Recommendations

If you notice fraudulent charges and suspicious activity on your accounts, please contact us.

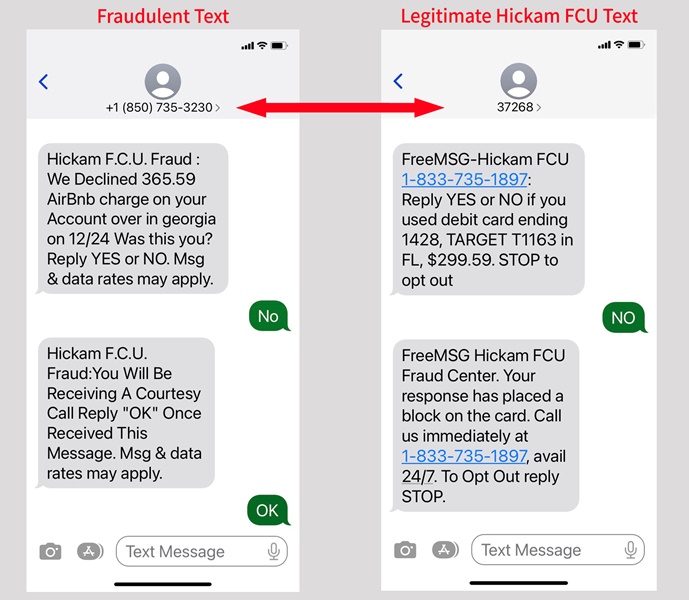

Fraudsters posing to be from Hickam Federal Credit Union are sending fake SMS text messages. If you receive a SMS text message appearing to be from Hickam FCU Fraud Department verifying transactions and text “You Will Be Receiving a Courtesy Call Reply “OK” Once Received This Message. Msg & data rate may apply” and you receive a call, DO NOT give sensitive information such as your account number, debit/credit card number, PIN number, expiration date of the card, 3-digit security code, online banking passwords, or personal information. Hickam FCU will not contact you to ask for this information.

If you receive a suspicious call or text message Contact us directly at (808) 423-1391.

Here is an example of a fraudulent text message compared to a real Hickam FCU text message:

On March 9, 2018, Zippy’s Restaurants discovered a data security incident with its credit and debit cards processing system that affected purchases made at Zippy’s Restaurant, Napolean’s Bakery, and Kahala and Pearl City Sushi between November 23, 2017–March 29,2018.

Typically after a security incident such as this, Phishing activities follow. As a reminder, Hickam FCU does not contact members and request PIN or personal information that we already have on file. We encourage all Hickam FCU cardholders to be vigilant about potential fraud and identity theft activities and to monitor their accounts through online banking and monthly statements for any suspicious activities. Should you notice any unusual transactions or have questions feel free to contact us.

Suspicious text messages are being forwarded to members stating "This message is from Mastercard. Your debit card has been locked, please contact us for assistance at 844-334-4730." If you receive such a text message, please disregard the message and do not call or contact the number in the text message.

Scammers pretending to be from a software company’s technical support are calling unsuspecting victims to gain access to their computers and bank accounts. Most scammers identify themselves as being from Microsoft. The caller advises the victim that an error or virus has been detected on the victim’s computer that could cause it to crash. The scammer offers to fix the problem for a fee in the guise of a life time anti-virus maintenance plan. The scammer may also ask you to download a software to find or fix the error. Doing so, may install a malware or spyware on your computer which would allow the scammer to remotely take control of your computer and gain access to password, bank accounts, and other private information.

Major software or computer companies do not make unsolicited phone calls to consumers informing them that something is wrong with their computer. If you receive one of these calls hang up. Or, if you feel you are a victim, run a legitimate virus scan, on your computer and then change passwords for email, online bank accounts, and other accounts. And, inform your financial institution or law enforcement authorities that you may been a victim.

Counterfeit Hickam Federal Credit Union cashier's checks appeared as far away as on the mainland. The scam started with a solicitation from a Mystery Shopper and the delivery of a fraudulent cashier's check. The scam then required the victim to purchase gift cards with the fraudulent check and the victim was then asked to send the PIN information on the back of the gift card to the fraudster. The counterfeit cashier’s checks looked legitimate and was reproduced using Hickam FCU's information and image. If you receive a solicitation from a Mystery Shopper and receive a Hickam FCU cashier's check, do not deposit or make any purchases. If you have questions to the authenticity of the check feel free to call the credit union at 808-423-1391 or toll-free from the mainland at 1-800-432-4328.

Home Depot announced that its payment data system was compromised and this breach affected purchases made at stores located in the U.S. and Canada since April 2014. Typically after an incident such as this, Phishing activities follow. As a reminder, Hickam FCU does not contact members and request the PIN or personal information that we would already have on file. Hickam FCU closely monitored the situation and encouraged all cardholders to beware of potential fraud and identity theft. Members who used their debit or credit card at Home Depot during the period affected were encouraged to closely monitor their accounts through online banking and monthly statements for possible suspicious activities. Should you notice any unusual transactions feel free to contact us.

Counterfeit cashier’s checks were produced using Hickam Federal Credit Union’s information and image. The counterfeit cashier’s check looked legitimate and the scam targeted individuals who used Internet classified ads to sell merchandise and work for hire employment.

The fraudulent Cashier's Checks were made out in an amount greater than the online purchase or work performed and the balance was then asked by the fraudsters to be delivered, wired, or forwarded to them in the form of cash cards. Individuals in various states including Hawaii received these checks and deposited them to their financial institution, which in turn alerted Hickam FCU of the counterfeit checks.

Please be aware that even if you are given immediate use of the funds from the cashier’s check, it does not mean the check is good. If the check is discovered to be fake, you will be responsible for the loss and may need to owe the credit union any funds you withdrew. If you think you are a victim, please contact the credit union immediately.

Hickam FCU completed its vulnerability assessment of the "Heartbleed" bug and was pleased to advise members that its online banking services and systems were not affected. We encouraged members to closely monitor their accounts for any unusual or unauthorized transactions and to exercise due diligence in protecting personal information, securing passwords, and maintaining security updates for their computers.

Automated phone messages identifying the caller to be from Hickam FCU informed the receiver that their debit or credit card had been blocked or cancelled due to fraudulent activity. The receiver was then instructed to press "1" and asked to provide their account information and personal identification. Anyone receiving this call was urged to hang up. And, if the victim inadvertently responded to this phone scam, they were advised to contact the credit union immediately. Hickam FCU does not generate automated recorded phone messages requesting more information about your account.

Fraudulent email messages were appearing to come from Hickam FCU Loans with various subject lines saying “Customer Invoice Reminder” or “Payment Reminder”. The fraudulent emails contained a link that may have been used to acquire private information or take the receiver of the email to a spoofed web site. If you received a suspicious email, delete the email, then empty your deleted items folder. And do not click on any links or open any attachments. Hickam FCU does not generate emails with links requesting more information about your account.

Several members received suspicious phone calls saying that there was an issue with their debit card and to enter the card number and follow directions on how to update their cards. The call originated from the area code of (503) and pretended to be our Card Fraud Center. Do not respond to these requests.

Be suspicious of calls posing as security employees, card companies and their fraud services, or other suspicious entities requesting for you to update, change, or provide personal information about your debit card, passwords and other secure information.

As a reminder, Hickam Federal Credit Union will never ask for your personal or financial information.

Also, monitor your card statements and accounts closely and report any unusual activities or discrepancies, as soon as possible.

A major card-processing payment company reported that its data system was breached compromising MasterCard, Visa, American Express, and Discover card accounts.

Please be on alert for any suspicious phone calls, email or text messages that requests personal or financial information. Do not respond to these requests.

Be suspicious of calls posing as security employees with Mastercard, Visa, or the other card companies, that say you have fraudulent charges and then ask for the three or four digit security code on the back of the card, enrollment passwords or security codes. Do not provide that code. Be suspicious of phishing scams via emails or text messages. Delete any unsolicited emails or text messages that ask for log-in information including password request.

Also, monitor your card statements and accounts closely and report any unusual activities or discrepancies.

As a reminder, Hickam Federal Credit Union will never ask for your personal or financial information.

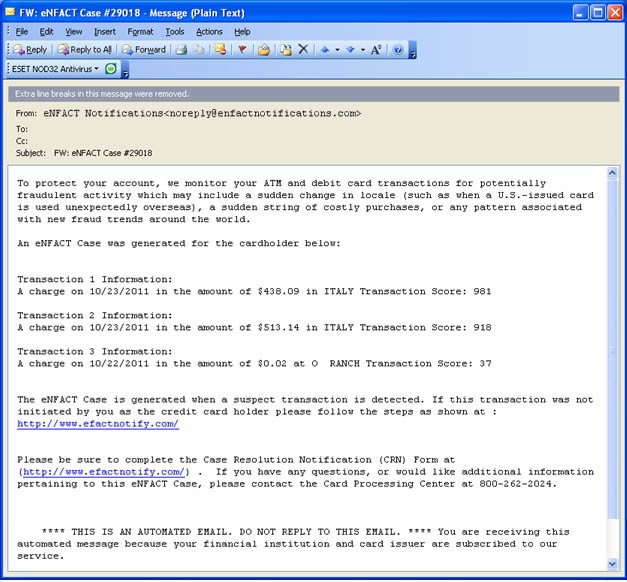

An email requesting to verify debit and/or credit card transactions had been reached by consumers. If you receive such an email, DO NOT click on any links within the email, or respond to the email to provide confidential account information. Hickam Federal Credit Union would never email members to verify transactions or request confidential account information.